On February 3, 1913, Delaware became the 36th state to ratify the Sixteenth Amendment. On February 25, 1913, then-Secretary of State Philander Knox (from Pennsylvania) announced that the amendment had been ratified by the necessary three-fourths of the states (six more states ratified the amendment after the fact). The amendment imposed a federal income tax on individuals. The text was pretty simple:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

The effective date of the Amendment was March 1, 1913, making the amendment nearly 100 years old (give or take a year or two) today. The federal income tax became the chief source of income for the government quickly thereafter.

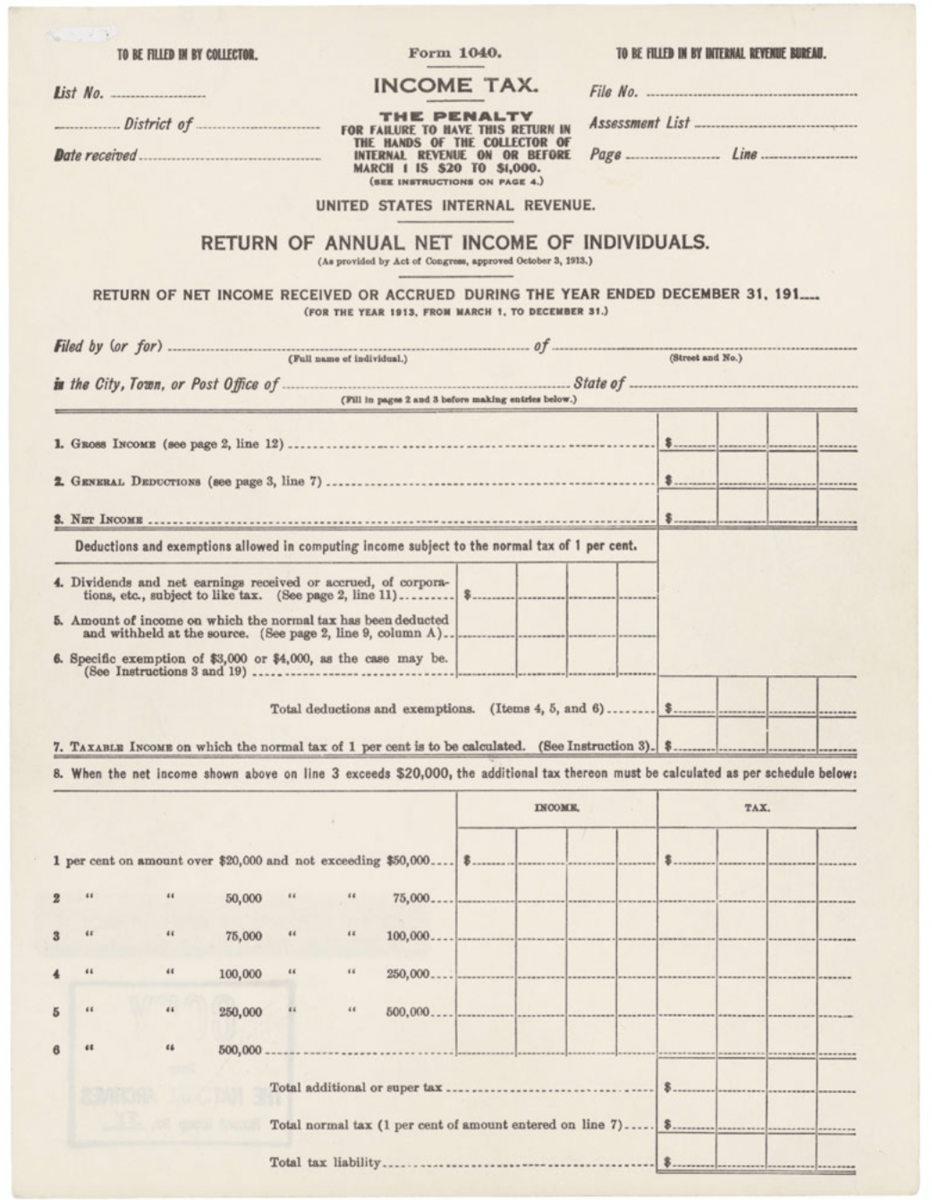

The due date for the original tax returns was initially March 1. You can see what the 1913 tax form looked like here:

Wow – pretty steep penalties! $1,000 in 1913 = $22,340 today!