With Election Day just around the corner, I’ve received a number of questions about the differences between the Obama/Biden and Romney/Ryan tax plans. It’s nearly impossible to compare the plans note by note for a couple of reasons:

- The plans aren’t etched in stone. Details on some parts of the plans are fuzzy and others are changing as election season continues.

- There are differences in the plans even from within the parties. Not all Democrats are on board with Obama’s plan and not all Republicans are on board with Romney’s plan. So see again #1.

What I thought might be useful – with those caveats in mind – were charts outlining the basics. I’ve created four charts:

- Income tax rates

- Income tax

- Federal estate and gift tax

- Corporate tax

Each chart indicates the current plan, the Obama proposal, and the Romney proposal, as I understand them today. That could, of course, change tomorrow (hey, this is politics). I’ve tried to be as accurate as possible, using the candidates’ commentary and debates as well as their web site for reference.

And, before you ask, no, there isn’t anything in the charts about Supreme Court Justices, women’s rights, immigration, and the like. While those things may touch on tax, the focus on this post is solely tax related.

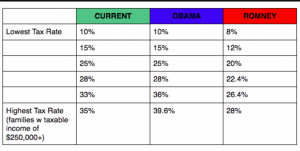

Most folks are concerned about income tax rates. Obama would allow existing rates to continue, except at the top. Here are the proposals:

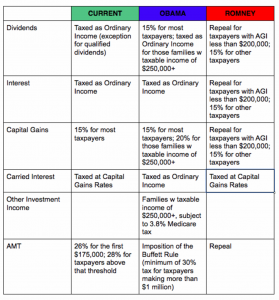

What actually gets taxed is also the subject of debate. Obama would eliminate most tax breaks for investment at the top while Romney proposes flattening investment taxes across the board.

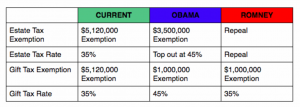

While the estate tax only affects those at the “top” – what actually constitutes the “top” has been a source of debate. Romney would eliminate the estate tax completely while retaining the gift tax.

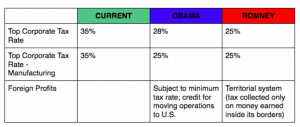

Finally, corporate rates got a lot of airplay during the debates. Both candidates would lower rates with Romney proposing to lower them more than Obama. Obama would limit deductions for expansion overseas while Romney would impose a territorial system of tax, meaning that the U.S. would not impose a tax on companies operating outside of its borders.

To get information straight from the sources, you can check out the candidates’ web sites:

And finally, for fun, consider following the candidates on Twitter. I’m sure they’ll be tweeting out tax and economics related information this weekend:

I’ll be tweeting, too, @taxgirl.

Still confused about parts of the plan? Not sure what AMT means or how it applies to you? I’ll be answering specific questions from readers through Election Day. If you have a question, send me an email and I’ll try to answer it. Please note that I’m looking for serious questions, not snark. I have enough snark for all of us. 😉