Tax season will open on Monday, January 23, 2023. What does opening the season mean? It means that IRS will officially begin accepting paper and

Read MoreCategory: IRS news/announcements

IRS Offers California Storm Victims Extra Time to File

The rains hit California hard this month. As of this morning, millions of California residents are still under a flood watch with more rain in

Read MoreMake Your 4th Quarter Estimated Payments By January 17

Heading back to the office is always challenging after the holidays. But as you get back to work—and get busy—don’t forget to make your fourth-quarter

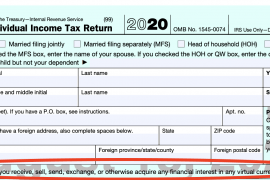

Read MoreIRS Fix Finally Complete for 2020 Taxpayers Who Claimed Unemployment

The IRS says that it has finished its review and issued automatic corrections for taxpayers who were improperly taxed on unemployment compensation for the 2020

Read MoreIRS Releases Mileage Rates For 2023 Tax Year

The Internal Revenue Service (IRS) has issued its 2023 standard mileage rates. Beginning on January 1, 2023, the standard mileage rates for the use of a car,

Read MoreIRS Puts Hold on Some Automated Return and Collection Notices

Earlier this month, the IRS announced that it would put a temporary hold on automated collection notices, unfiled tax return notices, and balance due notices

Read MoreIRS Confirms Stop on Selfie Technology, So What Happens Now?

At the start of tax season, I reported that the IRS was using new technology focused on photo identification for verification. Specifically, taxpayers who wanted

Read MoreIRS Announces February 12 As Tax Filing Season Open Date

The Internal Revenue Service (IRS) has announced that tax season will open on Friday, February 12, 2021. Yes, on a Friday. The IRS will begin

Read MoreIRS Opens Free File For Tax Season

Ready to file your 2020 tax return? The Internal Revenue Service (IRS) hasn’t officially announced the start date to the new season, but the website

Read MoreIRS Says Tax Forms Will Be Ready For The New Tax Season

With all of the last-minute changes to the Tax Code – and those stimulus check reconciliations – it was clear that the Internal Revenue Service

Read More