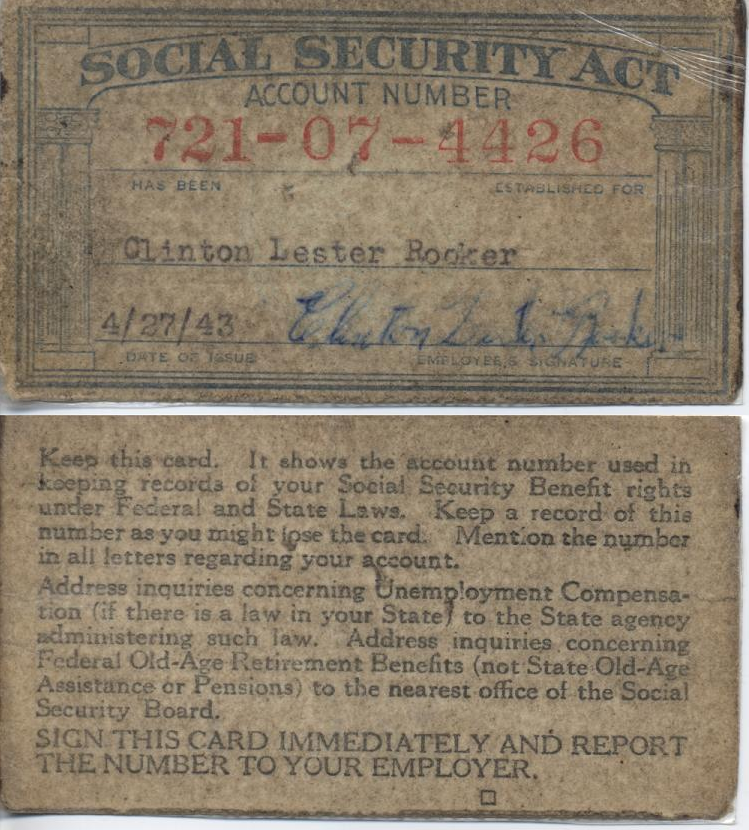

Charitable organizations and donors are breathing a sigh of relief after the Internal Revenue Service (IRS) dropped a proposal that would increase the amount of paperwork and personally-identifying information made available for charitable donations. Under the proposed rules, a charitable organization could ask donors for additional information, including the donor’s Social Security Number (SSN) when a charitable donation exceeded $250. The charitable organization could then use the information to provide the donor with an informational form to substantiate the donation instead of a traditional receipt or gift letter.

If it sounds duplicative and somewhat confusing, it is. Concerns about the new reporting scheme raised eyebrows from donors and charitable organizations almost from the date it was announced in September of 2015. The main worry? Data security.

Under the proposed rules, charitable organizations would have to collect and maintain additional information, including the SSNs of donors. That was an added burden that charitable organizations, quite frankly, didn’t want.

Donors worried, too. The golden rule of protecting yourself from identity theft is to be stingy with the information you provide to third parties – and that includes your Social Security Number. If donors felt pressed to turn over their personal information, charitable organizations worried that it might scare off potential donors. U.S. Senator Pat Roberts (R-KS), who publicly opposed the rule, said that the “rule would have had a chilling effect on charitable giving and would have added a costly burden to charitable organizations.” Last month, Sen. Roberts proposed a bill (S. 2370) to block the proposal from taking effect.

The bill is now moot following an announcement (downloads as a pdf) from the IRS that “the notice of proposed rulemaking is being withdrawn.” Sen. Roberts praised the decision, saying, “I am pleased the IRS has listened to reason and has scrapped this plan.”