I don’t collect a “candy tax.” The candy tax is a parenting trend where you purport to teach your kids about responsibility by stealing some of their candy levying a “tax” on their trick or treat loot. The tax can be as much as one-third of the candy “earned” on Halloween. The tax, which is levied in jest, is meant to teach a lesson about how government works. Only it’s not remotely comparable to the real thing. There are a few key concepts in the levying of the candy tax that don’t translate into the real world. Here they are.

Read MoreMonth: October 2016

IRS Issues Reminder That Forms W-2 Are Due Earlier, Some Tax Refunds Delayed, In 2017

If you’re a business owner, be sure to draw a red circle around the date January 31, 2017, on your calendar: that’s the new due date for filing forms W-2. Under the new law, the Protecting Americans from Tax Hikes (PATH) Act, enacted last December, the new filing deadline for employers to submit forms W-2 to the Social Security Administration, is January 31. Here’s more.

Read MoreDozens Of New Arrests Announced In Massive Multimillion-Dollar IRS Impersonation Scams

Today, the Department of Justice announced arrests of 20 individuals in the United States for their alleged involvement in the IRS impersonation scam calls.

Read MoreIRS Announces 2017 Tax Rates, Standard Deductions, Exemption Amounts And More

The Internal Revenue Service (IRS) has announced the updated numbers for 2017. You’ll find the 2017 tax rates, standard deductions, personal exemptions, and more here.

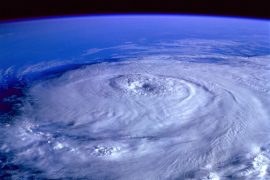

Read MoreIRS Announces Relaxed Retirement Plan Rules For Victims Of Hurricane Matthew

The Internal Revenue Service (IRS) has announced that 401(k)s and similar employer-sponsored retirement plans, including 403(b) and 457(b) plans, can make loans and hardship distributions to victims of Hurricane Matthew and members of their families.

Read MoreI Said I Wouldn’t But I Did: I Bought A House

I bought a house today. Yes, after I said I hoped never to buy a house again. Here’s why I did it and why my advice about homebuying and taxes, as well as renting, still hasn’t changed.

Read MoreLive Blog, Fact Checked: The Third 2016 Presidential Debate (October 19, 2016)

Welcome to our live coverage of the October 19, 2016, presidential debate. This debate is the third and final debate of the current election season.

Read MoreOn Anniversary Of Al Capone’s Prison Stint, IRS Delivers 2nd Gun To Mob Museum

It was 85 years ago today that the feds finally got their man: on this day in 1931, Al Capone was finally sentenced to serious prison time. Despite Capone’s reputation, he wasn’t put away for murder or gambling or bootlegging but for tax evasion.

Read MoreIRS Announces Additional Tax Relief For Victims Of Hurricane Matthew

The Internal Revenue Service (IRS) has announced additional tax relief for victims of Hurricane Matthew. Storm victims in much of North Carolina and parts of South Carolina, Georgia, and Florida have until March 15, 2017, to file certain individual and business tax returns and make certain tax payments.

Read MoreNew Charges, New Defendant In School Funds & Tax Fraud Case Involving Former Congressman

Prosecutors have filed an indictment charging David T. Shulick, former president of the Bala Cynwyd-based Delaware Valley High School Management Corp., of embezzling funds from the School District of Philadelphia (SDP). The charges are linked to a scheme involving Chaka “Chip” Fattah Jr., son of former Congressman Chaka Fattah. Fattah Jr. was charged and ultimately jailed for his role in the scheme.

Read More