It’s Ask The Taxgirl! Today, I focus on what to do with a corrected W-2 (otherwise known as a form W-2c).

Read MoreYear: 2018

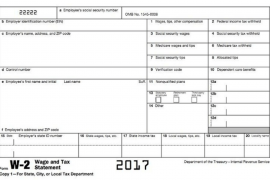

How To Read Your Form W-2

Here’s what you need to know about the form W-2, Wage and Tax Statement, for 2018.

Read MoreAsk The Taxgirl: Dealing With An Uncooperative Tax Preparer

It’s Ask The Taxgirl! Today I tackle how to handle an uncooperative tax preparer.

Read More10 Facts About Presidents And Tax

We’re celebrating Presidents’ Day across the country today – even though that’s not 100% accurate. To mark the day, here are ten quick facts about tax and our presidents.

Read MoreDo You Need To Pay Tax On Social Security Benefits?

At the end of last year, nearly 67 million people collected a Social Security check. The majority of those beneficiaries (47 million) were over the age of 65. Each year, many seniors grapple with whether any or all of those benefits are taxable. Here’s what you need to know.

Read MoreBe Prepared To Prove Your Identity When Calling The IRS

With tax refund scams on the rise and identity theft a pressing concern, be prepared to answer more questions when you reach out to the Internal Revenue Service (IRS).

Read MoreIRS Issues Urgent Warning On New Tax Refund Scam

Just when you thought you’d read about all of the tax scams: The Internal Revenue Service (IRS) is warning taxpayers about a new – and growing –

Read MoreTreasury Proposes To Strike Hundreds Of Tax Regulations

The U.S. Department of the Treasury has proposed the repeal of nearly 300 tax regulations that are “unnecessary, duplicative or obsolete and force taxpayers to navigate needlessly complex or confusing rules.” Tax Regulations are considered the official interpretation of the Tax Code.

Read MoreIf You’ve Already Filed, Here’s How To Claim Tax Extenders

As of last week, the Internal Revenue Service (IRS) had already received 18,302,000 tax returns and had processed 17,931,000; that number is likely double by now. If you’ve already filed your tax return and think you might be affected by the tax extenders provisions, here’s what you need to do.

Read MoreTax Facts Mixed With IRS Tax Fiction

The 2018 filing season kicked off on January 29, 2018. Here’s a mix of facts and fiction – including tax refund information – to help you navigate the tax season.

Read More