Days after the Internal Revenue Service (IRS) released two new pieces of guidance for taxpayers who engage in transactions involving virtual currency, the IRS announced another compliance measure: a checkbox on form 1040. The checkbox, which appears on the early release draft of the form 1040, asks taxpayers about financial interests in virtual currency.

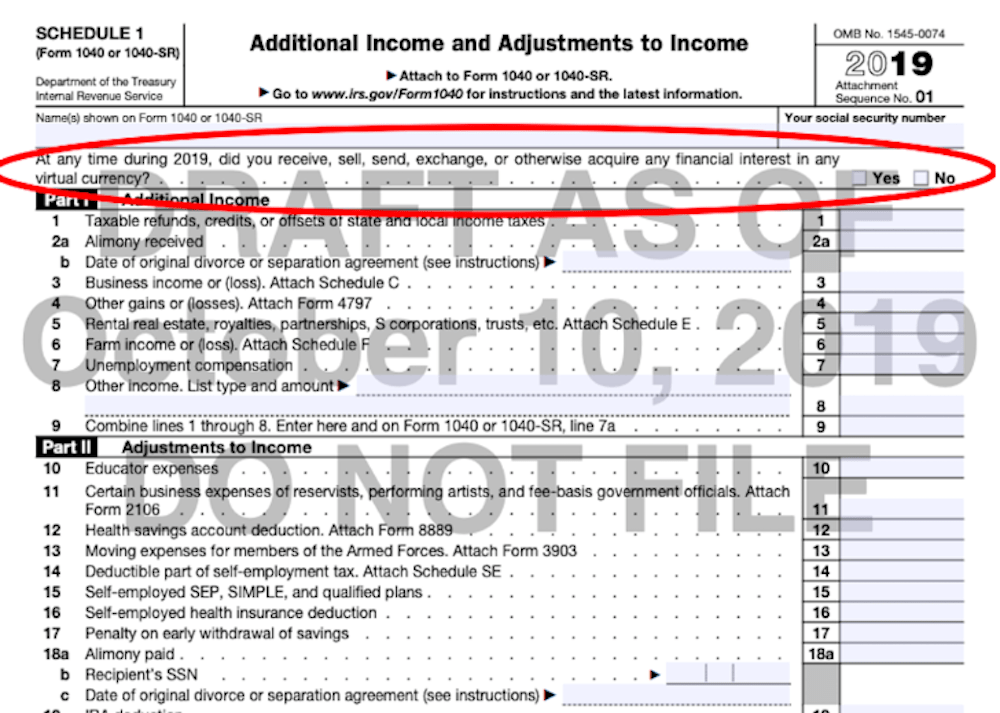

The checkbox appears on the second early release draft of the 2019 Form 1040, Schedule 1, Additional Income and Adjustments to Income (downloads as a PDF). The checkbox is at the top of Schedule 1, which is used for reporting income or adjustments to income that can’t be entered directly on the front page of form 1040:

The question is:

At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?

If you’re wondering why that sounds familiar, the wording closely parallels the verbiage on Schedule B, Part III, concerning offshore accounts. That question appears at the bottom of the Schedule. It asks:

At any time during 2018, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign country?

The similarities aren’t surprising. You may recall that I’ve suggested before that the strategy the IRS is using to pursue cryptocurrency is reminiscent of how the agency chased down offshore accounts.

However, I’m not overly keen on the location of the cryptocurrency question. As noted, taxpayers who file Schedule 1 to report income or adjustments to income that can’t be entered directly on Form 1040 should check the appropriate box to answer the virtual currency question. But taxpayers who don’t have to file Schedule 1 for any other purpose may not be aware that they need to file Schedule 1 to answer to this question if it applies to them. Yes, tax software interviews will likely catch it – but what if they don’t? Or what if taxpayers are completing the form by hand? Or if tax preparers don’t think to ask?

I think it’s something that IRS will need to address. The IRS will accept Schedule 1 comments via email at WI.1040.Comments@IRS.gov for a 30-day comment period beginning October 11, 2019. The IRS cannot respond individually to each comment received, but all feedback will be considered.

Why does the location of the checkbox matter? Compliance. The checkbox is ostensibly on the form to remind taxpayers to report their cryptocurrency transactions. But those tax professionals like me who have seen the response to the checkbox on Schedule B know that this is also an easy way to hold those who don’t check the box – even by accident – accountable. The IRS can and has taken the position that willfully failing to check the box related to offshores interests can form the basis for criminal prosecution. Failing to check the box by accident can still result in headaches and penalties. I fully expect a similar result on the cryptocurrency side.

If you’re looking for more information on cryptocurrency, you can read more about the recent guidance here. You can find out more about the taxation of cryptocurrencies like Bitcoin here. And you can get up to date about how the IRS is targeting non-compliance through a variety of efforts, ranging from taxpayer education to audits to criminal investigations here.