Taxpayers still aren’t rushing to file: that’s the initial takeaway from a second set of statistics released by the Internal Revenue Service (IRS).

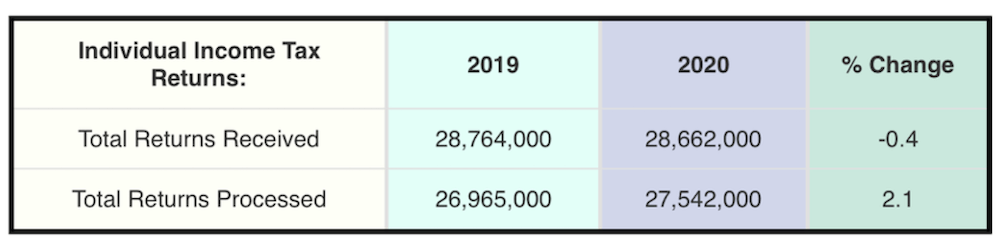

Tax season opened on time on January 27, 2020, one day earlier than in 2019. As of the end of the second full week of tax season (ending February 7, 2020), the IRS had received 28,662,000 individual income tax returns. That compares with 28,764,000 received by the same time in 2019, a drop of .4%. On its face, that’s not a significant drop, but compared to the 2018 numbers, the decrease is noticeable. In 2018, the IRS received 30,881,000 individual income tax returns by the second week of the filing season, a drop of nearly 7%.

While taxpayer numbers are down, the IRS appears to be picking up speed: the rate that individual income tax returns were processed has increased. The IRS processed 27,542,000 individual tax returns, an increase of 2.1%. The processing rate stands at about 96% – not bad for this early in the tax season.

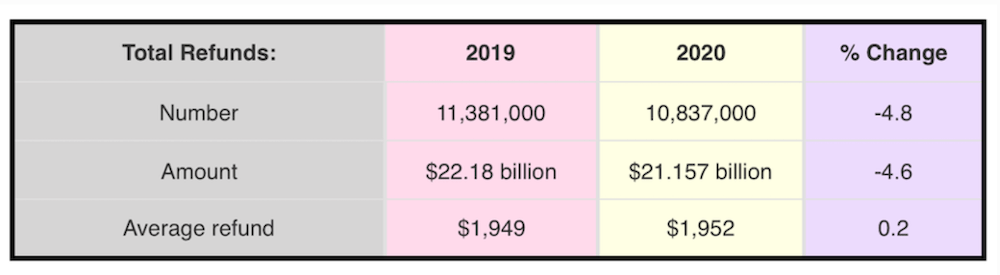

And what about those tax refunds? Typically, taxpayers with simple tax returns who count on their tax refunds file early in the tax season.

By the end of the second week, the IRS issued 10,837,000 tax refunds as compared to 11,381,000 – a drop of 4.8%. But compared with those 2018 numbers? The IRS issued 13,517,000 tax refunds for the same period in 2018. That’s a drop of about 20% over two years. The total value of tax refunds issued this tax season is $21.157 billion, down 4.6% for the prior year (and tracking with the number of refunds). Fortunately for taxpayers, the average tax refund is up a few dollars: $1,952 per taxpayer, up .2% from the same period in 2019.

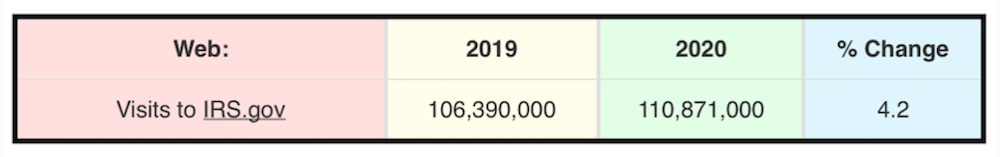

Also up? Visits to irs.gov. The IRS reported 110,871,000 visits to the website, up 4.2%.

As before, this early in the filing season, there’s not a lot that can be deciphered from the data. Some tax professionals are still pointing to confusion over tax extenders while others say that the mandatory refund waiting period for taxpayers who claim the earned-income tax credit (EITC) and the additional child tax credit (ACTC) may mean that taxpayers are adjusting their filing schedules.

And yes, I know that it’s the end of February: IRS has not updated its filing stats since the week ending February 7, 2020.

It sure feels like tax season is just getting started: Tax Day is April 15, 2020, for most taxpayers.