(Updated: April 27, 2020)

Stay-at-home orders may remain in effect in some states, but the federal government is sending some folks back to work. Specifically, the Internal Revenue Service (IRS) is bringing employees back to work starting on Monday.

The agency has mostly been in shut down mode since March 24, 2020, when employees confirmed that some IRS call centers and return processing centers were closing in response to COVID-19. On March 25, 2020, the IRS noted that all Taxpayer Assistance Centers (TACs) were closed until further notice. Two days later, the IRS confirmed that “Due to staff limitations, the Practitioner Priority Service (PPS) line, the e-Services Help Desk line and the e-Services, FIRE, and AIR system help desks are closed until further notice.” The IRS also advised that it was temporarily suspending acceptance of new Income Verification Express Services (IVES) requests; there were also delays in Centralized Authorization File (CAF) number authorizations. And as of April 21, 2020, the IRS reiterated that it was not currently able to process individual paper tax returns, including amended returns.

But now, things are changing. According to the agency, “Consistent with OMB and OPM guidelines and to serve the urgent tax administration needs of the American people during these times, the IRS has requested, but not required, several thousand employees to volunteer to return to work along with an offer for incentive pay.”

The agency emphasized that, “The safety and well-being of IRS employees and taxpayers have been, and remain, our top priority.” The IRS says that it will continue to implement, follow — and where possible exceed — specific federal safety guidelines and measures, including social distancing at all facilities.

However, according to an IRS memo released by House Ways and Means Committee Chairman Richard Neal (D-MA) and Rep. John Lewis (D-GA), “[a]lthough the IRS is seeking to procure personal protective equipment (PPE) such as masks and gloves, each IRS facility may not be able to initially procure the PPE for all employees immediately.” That means that employees are required to bring their own masks when they come to work.

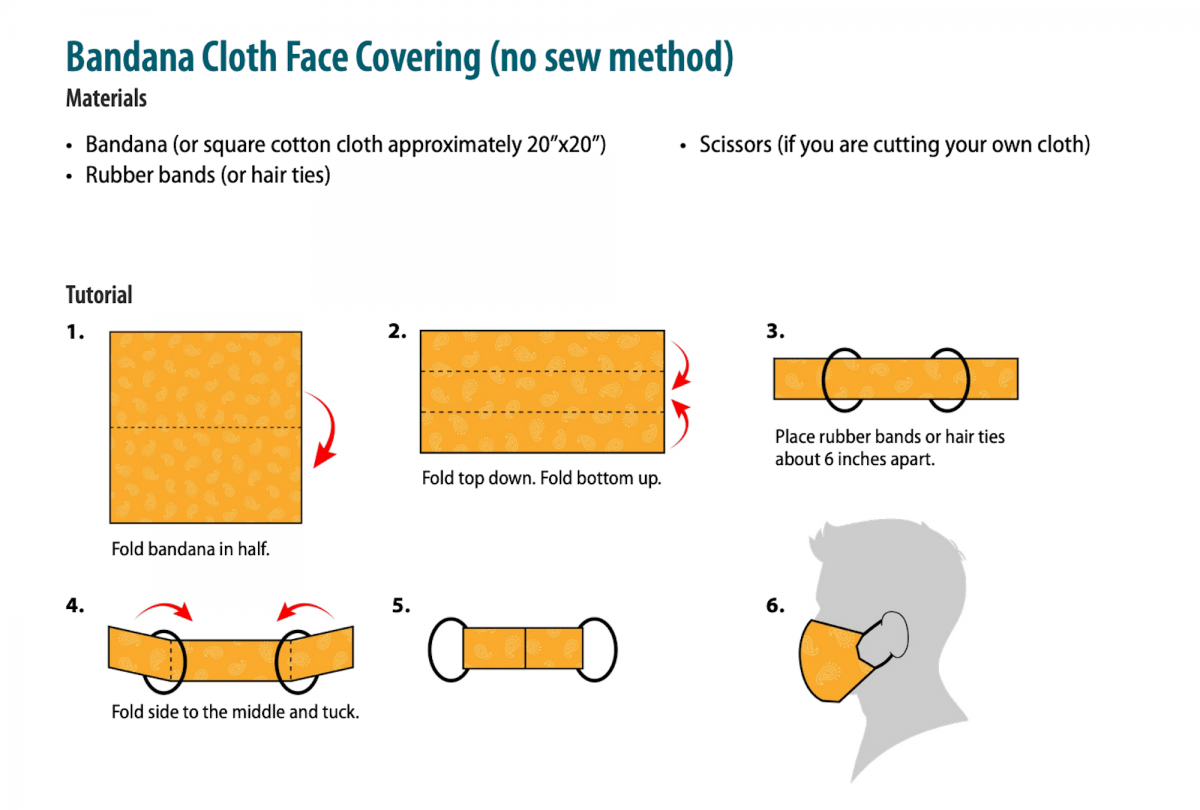

As a helpful tip, employees are directed to the CDC website for instruction on how to make their own face coverings from common household materials, like clean t-shirts or bandanas. Here’s an example:

(No, that’s not a joke.)

According to the IRS, “No employees have been requested to return to work in a manner inconsistent with federal COVID-19 guidelines, and the requirement for employees voluntarily returning to the workplace to wear face coverings is an example of the IRS exceeding the federal safety guidelines and measures.”

Some workers have been working remotely from home. Still, according to the IRS, “it is essential that the IRS resumes a number of key responsibilities, including opening mail that has been held for a number of weeks, processing of paper tax returns that may offer refunds to taxpayers, working on returns with refundable credits, answering taxpayers’ questions on our toll-free lines, and performing Income Verification Express Service and certain lien/levy functions.” There’s no firm indication of how many employees will return, nor which phone lines will re-open.

The IRS says that it “will continue to do everything possible to protect employees while also providing important services and assistance to the nation’s taxpayers.”

The National Treasury Employees Union (NTEU) issued a statement, acknowledging that “The IRS has informed NTEU that it is has begun the process of recalling certain employees to return to their posts of duty for mission-critical work that cannot be done remotely. We appreciate that the agency said it will first solicit volunteers, with incentive pay, to return to the workplace.”

The NTEU confirmed that employee tasks would “include opening taxpayer correspondence, handling tax documents, taking taxpayer telephone calls and performing other functions related to the filing season.”

The NTEU also confirmed that this is a voluntary move, but “[i]f there are not enough volunteers, the agency will direct employees to return to the workplace.” The NTEU believes that those who are successfully working from home should remain on telework until all state and local stay-at-home orders are lifted and health and safety precautions have been met.

According to the NTEU, this initial wave of employee recalls will total roughly 10,000 employees at the agency’s 10 campus locations. The NTEU is communicating with the IRS about working conditions at those facilities to make sure there are adequate cleaning and disinfecting supplies, accommodations to allow for physical distancing among employees and personal protective equipment, including masks and gloves.

The NTEU is the nation’s largest independent union of federal employees – including IRS employees. Even though most IRS employees have not been physically at work, as of April 17, nearly 88 million individuals have received Economic Impact Payments (EIPs) or stimulus checks worth almost $158 billion. However, many taxpayers have complained about the difficulty of reaching IRS employees by phone to resolve tax season issues, including missing refunds. Filing deadlines remain July 15, 2020, for most taxpayers.