Tax season will officially open on January 23, 2023. Now is a good time to start getting organized. The first step for many taxpayers? Finding those tax forms.

If you don’t have have your tax forms in hand just yet, keep checking the mail: Employers are supposed to provide employees with Forms W-2 and other wage statements by January 31, 2023.

The 2015 PATH Act made changes to the way we file taxes. Now, employers file copies of Form W-2, Wage and Tax Statements, and Form W-3, Transmittal of Wage and Tax Statements, with the Social Security Administration by January 31. That is also the date that Forms W-2 are due to employees.

One in-demand form, the re-introduced Form 1099-NEC, Nonemployee Compensation, is also normally due to taxpayers on January 31, 2023.

January 31 is the same deadline for your Form 1099-K, Payment Card and Third Party Network Transactions. Don’t worry, despite the outdated info on the IRS 1099-K page, the reporting threshold for Form 1099-K remains $20,000/200 transactions and not $600. The reporting changes were originally scheduled to take place this year but the IRS announced in Notice 2023-10 that 2023 would, instead, be a transition year. Assuming no changes from Congress, we’ll see forms reflecting the new reporting threshold in early 2024—so you get a pass this year.

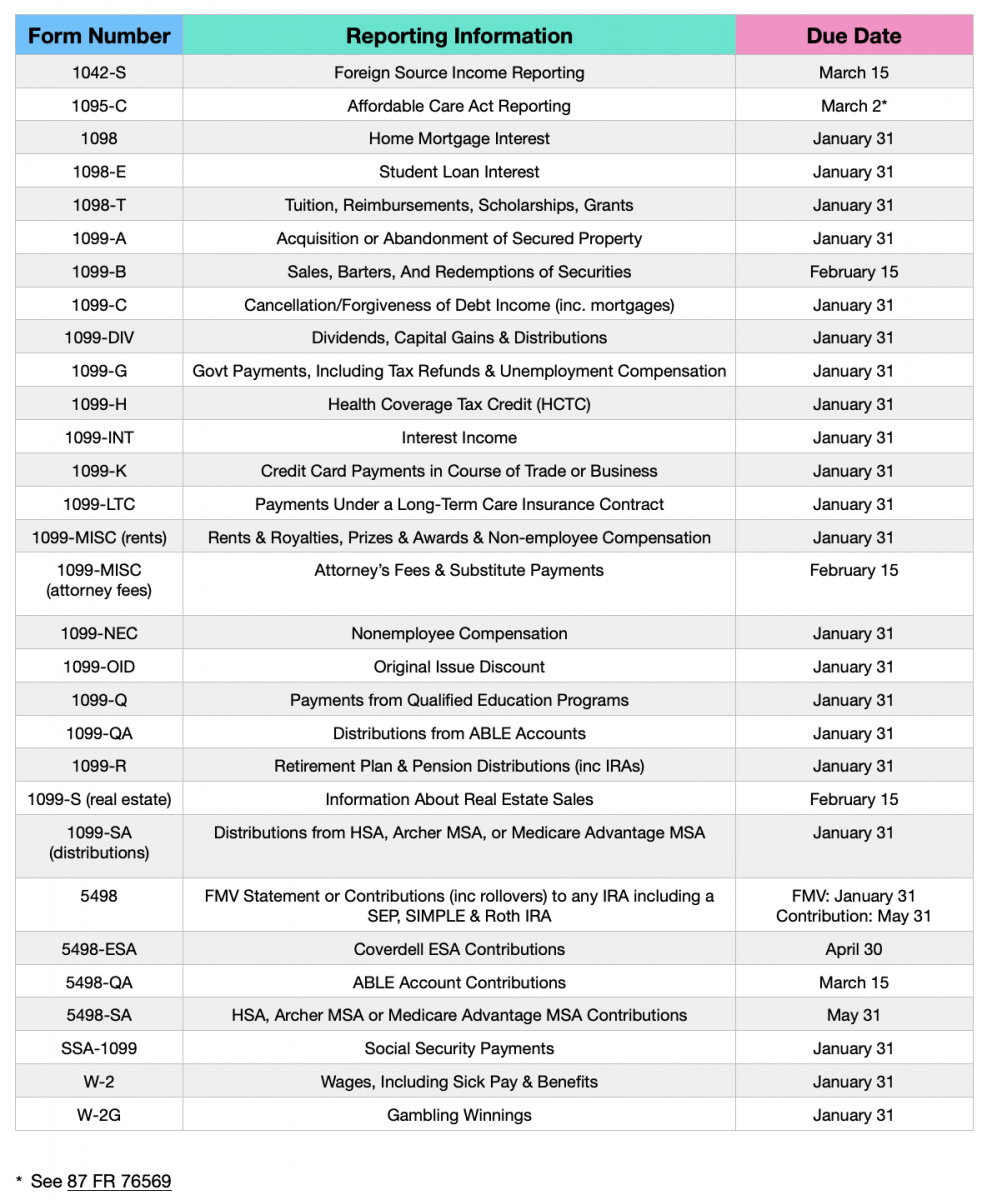

Here’s a look at some other form due dates: