By now, you probably have a stack of tax forms from employers, banks, stockbrokers, lenders, and more on your desk – or more likely, the kitchen counter. For some of you, those tax forms will end up in the hands of your tax professional; the rest of you will input the information on those forms, box for box, into tax preparation software – maybe with a little swearing along the way. No matter how you plan to do your taxes this year, you likely don’t know what all of the numbers, letters, and other information on those forms mean. That’s about to change. This is the fifth in a series of posts meant to help you make sense of all of those forms.

Here’s what you should know about the form 1099-A, Acquisition or Abandonment of Secured Property:

A form 1099-A, Acquisition or Abandonment of Secured Property, is issued by a lender when the lender receives an interest in property that was meant to be in full or partial satisfaction of the debt, or if the lender has reason to know that the property has been abandoned.

For purposes of the form 1099-A, property means any real property (such as a personal residence), any intangible property, and tangible personal property. However, the form 1099-A is not used to report tangible personal property, like a car, held for personal use (if it’s for trade or business or for investment, even if only partly, the form 1099-A is required). Additionally, no reporting is required if the property securing the loan is located outside the United States, and you, as the borrower has furnished the lender a statement that you’re an exempt foreign person.

Abandonment occurs when it appears that you, as the borrower, intended to and permanently walked away from the property. The determination is based on facts and circumstances known to the lender.

You’ll want to pay attention to this form because, in some circumstances, you may have to treat the abandonment as though you sold the property. Because of the potential consequences, you’ll want to make sure that the information reported on the form is correct. If it’s not, you’ll need to contact the lender to make corrections.

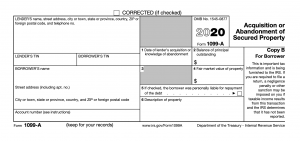

The form 1099-A typically looks like this:

The payer’s identifying information is reported on the top left side of form 1099 while your identifying information is reported on the lower left side of the form. This includes your name and your address. Your Social Security Number may also be on the form – or just the last few digits. The first digits of the number may be redacted for your privacy (this is a relatively new development for certain forms); no matter what your copy indicates, the lender will report your entire Social Security Number on the Copy A provided to IRS.

Often, on tax forms, the account number is considered optional – you might see them or you might not. However, you’re more likely to see them on a form 1099-A than not: the IRS encourages lenders to include them on the form.

In box 1, you’ll see a date. That date is either the date that the property was considered abandoned or the date the lender acquired the property.

The amount that you still owed on the loan as of the date in box 1 is reported in box 2. This amount only includes principal: accrued interest or foreclosure costs are not includible.

You won’t see anything in box 3 as it’s “reserved.”

The fair market value (FMV) of the property is reported in box 4 for a foreclosure, execution, or similar sale.

If you were personally liable for repayment of the debt, you’ll see an “X” in box 5. Typically, if you’re personally liable, the lender can collect on the debt even after the lender has taken the collateral (like home).

Box 6 is pretty self-explanatory: it’s a general description of the property. For real property, that means the address. If it’s personal property, you’ll see a description of the property like “1984 Ford Grenada.”

If the debt is canceled and is in connection with a foreclosure or abandonment of secured property, you should not receive a form 1099-A and a form 1099-C: you should only receive a form 1099-C. However, if you do receive both for the same property and from the same debtor, there should be empty boxes (4, 5, and 7) on form 1099-C. You’ll see more on form 1099-C later in the series.