Taxpayer asks:

Dear Taxgirl,

Hi! My son has received a corrected w2 from his employee. On box 12 it has 2 12a dd and 2 different amounts. He doesn’t have an option for 2 12a dds. Is this normal?

Taxgirl says:

If an employer makes a mistake on a form W-2, the employer will issue a corrected form W-2, called a form W-2c, Corrected Wage and Tax Statement.

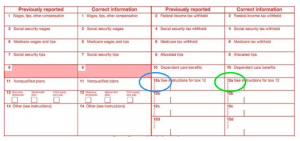

The form W-2c can be confusing because it includes the original (incorrect) amounts, as well as the corrected amounts. Even more confusing, there are no real distinguishing features between the two on the form other than the headers on the top of the columns. I’m guessing that is what’s throwing you in this case.

Take a look at the form. The first amount listed at box 12a (located at the spot where I’ve placed a blue circle on the blank form above) should match the incorrect amount originally reported to your son on his first form W-2. The second amount listed at box 12 (located at the spot where I’ve placed a green circle on the blank form above) should be the correct amount.

So what do you do with the form W-2c?

- If you have already filed your tax return, you may need to file an amended return (but see below).

- If you have not yet filed your tax return, just use the corrected amounts as reported on the W-2c on your tax return.

In this case, if the “DD” amount at box 12 is the only correction, the good news is that it won’t change your tax picture. The numbers labeled “DD” simply indicate the amount of employer-provided healthcare. Your employer is required to report this amount but it is not taxable. If that’s the only change for your son, you will not need to amend any previously filed return.

For more on understanding your form W-2 – including a list of box 12 codes – check out this article.

Before you go: be sure to read my disclaimer. Remember, I’m a lawyer and we love disclaimers.

If you have a question, here’s how to Ask The Taxgirl.