I’ll admit it – as if you hadn’t already guessed – I’m a bit of a geek. And not just a tax geek. I like math. And charts.

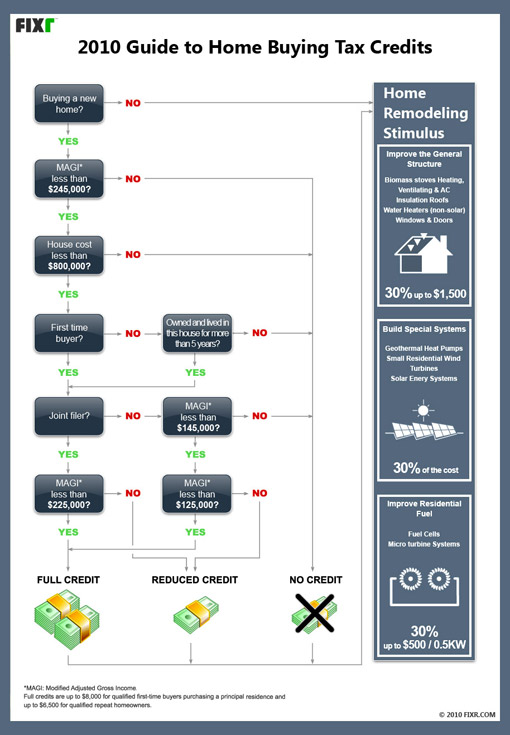

So I was pretty psyched when @fixR-com sent me a note on twitter about their homebuyer’s credit pictograph. It’s a really good representation of the credit and they have been gracious enough to give me permission to publish it on my site. Here it is:

Source: FixR

If you want more info on the homebuyer’s credit, you can check out these Ask the taxgirl answers:

- Mortgage and Housing Tax Credit

- Same-Sex Couples and the Homebuyer’s Credit

- MFS and the Homebuyer’s Credit

- Renting and the Homebuyer’s Credit

- Co-Signers and the First Time Homebuyer’s Credit

Nice chart, but its missing a link for answering No to “Owned home and lived in this home for more than 5 years”. I believe the answer to that response would be “No Credit”

They make every part of the tax code complicated on purpose.

There’s some truth to that… but I don’t think it’s *just* to make it complicated. I think Congress tries to write these crazy laws to win votes and ends up fouling up this one. I can just hear the conversation, “So people like these home credits and the real estate folks want it, so let’s do it again. Only let’s include more people – even people who have already bought a house. But not kids – we forgot about that last time, so no kids. And no foreigners, my constituents wouldn’t like that. And no rich people – but let’s say more income than before…”

And so it goes.

OF COURSE they make it complicated–they have to make sure rich people (and corporations) get the money, the poor don’t have to pay for it, and, above all else, under any circumstances, I, as a healthy white single male who is a recent but not current homeowner and not self-employed or a business owner, or a student or parent, but has a certain level of income near the soc sec income cap, above all else I specifically should NEVER get ANY tax break, rebate, credit, forgiveness, deduction, exemption, or waiver. Never have in the past 15 years, other than the very minor income tax rate change, and I expect I never will.

It’s hard to do that, so the rules have to be complicated.