Taxpayers are still taking their time to file: that’s the takeaway from recent filing statistics released by the Internal Revenue Service (IRS).

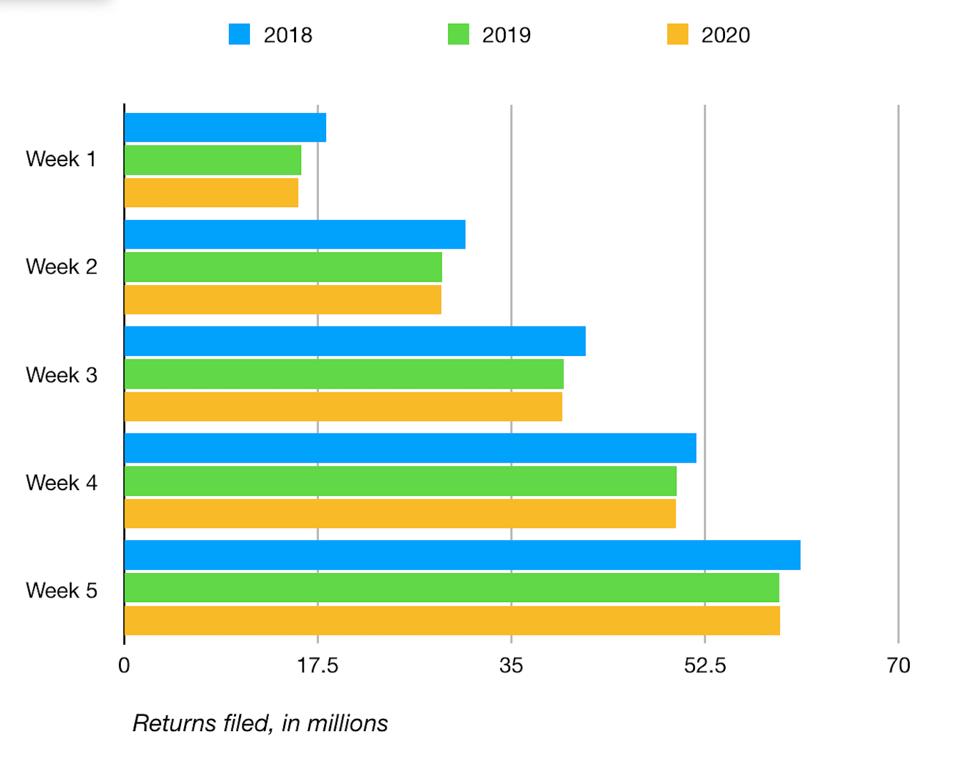

Tax season opened on time on January 27, 2020, one day earlier than in 2019. As of the end of the first few weeks of tax season (ending February 28, 2020), the IRS had received 59,305,000 individual income tax returns. That compares with 59,223,000 received by the same time in 2019, a slight increase of 0.1%. That’s better than earlier numbers but still lower than those 2018 numbers. In 2018, the IRS received 61,150,000 individual income tax returns by the same time in the filing season.

Here’s how the numbers compare in 2017, 2018, and 2019, week-by-week:

The rate of processing for individual income tax returns has increased a bit. The IRS processed 57,085,000 individual tax returns, an increase of 0.4%. The processing rate still stands at about 96%.

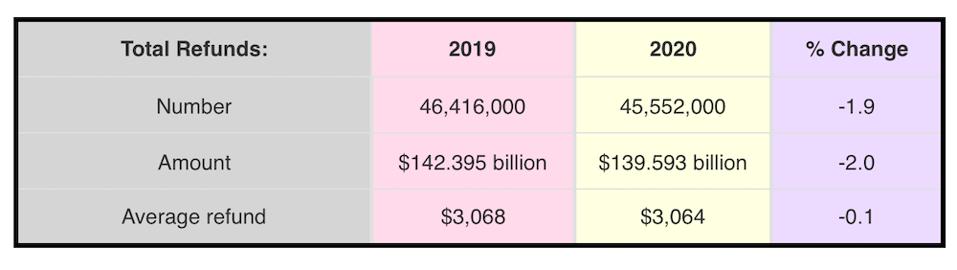

And what about those tax refunds? Typically, taxpayers with simple tax returns who count on their tax refunds file early in the tax season. However, refunds remain lower overall – in terms of numbers and dollars – than for the same time last year.

The IRS issued 42,636,000 tax refunds as compared to 43,241,000 – a drop of 1.4%. But compared with those 2018 numbers? The IRS issued 48,452,000 tax refunds for the same period in 2018. That’s a drop of nearly 10% over two years. The total value of tax refunds issued this tax season is $134.202 billion, down 1.8% for the prior year (and tracking with the number of refunds). That reflects a nearly 10% drop in the value of refunds since 2018. Fortunately for taxpayers, the average tax refund is holding somewhat steady: $3,148 per taxpayer, down just .3% from the same period in 2019.

But, what is up markedly? Visits to irs.gov. The IRS reported 291,906,000 visits to the website, up a whopping 7.1%.

Anecdotal evidence from tax professionals back up these numbers. Several have reported – mainly on social media – that client visits are down. The numbers appear to correlate those stories. Of the 56,736,000 returns that have been filed electronically to date (a 96% rate), the numbers of professionally-prepared returns drop 2.2%. In contrast, the number of self-prepared returns increased by 2.9%.