(Updated with new information: April 15, 2020, in the afternoon).

The Treasury Department and the Internal Revenue Service (IRS) have released a new web tool that will allow taxpayers to update their direct deposit information to receive their stimulus checks (Economic Impact Payments) more quickly. This tool, which is now available, is available to those taxpayers who have filed 2018 and/or 2019 tax returns and is separate from the tool used by non-filers.

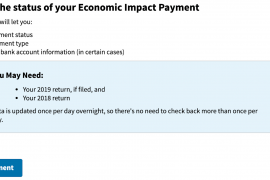

The new tool, Get My Payment will:

- Provide you with the status of your payment, including the date your payment is scheduled to be deposited into your bank account or mailed;

- Advise you of your payment type; and

- Allow eligible taxpayers a chance to provide bank account information to receive payments more quickly rather than waiting for a paper check. This feature will be unavailable if your payment has already been scheduled for delivery.

Entering bank or financial account information will allow the IRS to deposit your payment directly into your account. Otherwise, your payment will be mailed to you as a paper check.

To use the tool, click over to the link at the IRS website.

Have your 2019 tax return (if filed) and your 2018 tax return handy.

You’ll be asked to enter a few bits of key information, including your Social Security Number, date of birth, and address.

The instructions do not specifically advise, but this information needs to match what the IRS has on file (with your last filed return).

According to the IRS, your payment using the information you provided with your 2019 tax return.You will not be able to change it. For folks who filed a 2018 return, if you need to change your account information or mailing address, you should file your 2019 taxes electronically as soon as possible.

Also, the IRS is not currently able to process individual paper tax returns due to the COVID-19 outbreak. Please be aware of this since, if you file an amended tax return, you can only file with paper.

Checksare already hitting bank accounts. For security reasons, the IRS plans to mail a letter about the economic impact payment to your last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment.

Eligible taxpayers who filed tax returns for 2019 or 2018 – and have direct deposit – will receive the payments automatically. As I’ve previously reported, automatic payments will also go out shortly to those receiving Social Security retirement or disability benefits and Railroad Retirement benefits.

Keep in mind that the payment is NOT taxable and will not affect your 2020 refund. If you have other questions, please check out these articles.

Things are happening at a rapid-fire pace these days. As tax updates become available, we’ll keep you updated. Keep checking back for details.