Estimated reading time: 3 minutes

With all of the last-minute changes to the Tax Code – and those stimulus check reconciliations – it was clear that the Internal Revenue Service (IRS) was going to have to make revisions to tax forms used to file 2020 tax returns (the tax returns that you’ll file in 2021). Most tax professionals expected a delay in getting those forms together, but the IRS has issued a statement confirming that “updates to key federal tax forms and instructions are complete and will be available when Americans begin filing their tax returns.”

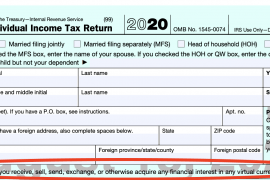

Most taxpayers file Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Tax Return for Seniors. Last month, the IRS released the very-probably-unless-Congress-does-something-soon final version of Form 1040 for 2020. There were several notable changes to the form for the tax year 2020: you can read about them here.

The IRS says that those returns are ready, and that they have shared the updates with its software and industry partners. Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov and are being printed for taxpayers who need a hard copy.

Stimulus Checks

A key change on the returns is the reconciliation for the Economic Impact Payments, or stimulus checks. Those checks are an advance payment of the Recovery Rebate Credit. It’s important to note that:

- Anyone who didn’t receive the full amount of both stimulus checks should include the amounts they received, before any offsets, when they file. This includes taxpayers who did not receive the proper amount for their dependents.

- Anyone who received the full amount for both stimulus checks should not include any information about the payments when they file their tax return.

- The stimulus checks will not reduce the amount of your refund.

- The stimulus checks are not taxable.

You can read more about stimulus checks here.

Changes To Form 1040

Also new on the returns is the option to use your 2019 income amounts when computing the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC). This is the result of the additional stimulus bill passed in December and significantly impacts those families whose incomes were reduced because of COVID since your credit is typically higher as you earn more money.

And, of course, with Bitcoin riding high, don’t forget about cryptocurrency. A question about cryptocurrency ownership has been moved to the front page of Form 1040. You can find out more about that – and form other changes – here.

IRS Filing Season Start Date

The IRS has not yet announced a start date for the 2021 filing season. Last year, the IRS announced on January 6, 2020, that the filing season would open on January 27, 2020. Most forms W-2 and other tax forms are due to taxpayers by February 1, 2021 (find out more here).

Last year, FreeFile opened on January 11, 2020. The IRS says that IRS Free File “will open in mid-January” when participating providers begin accepting returns. However, according to the IRS, Free File providers will accept completed tax returns and hold them until they can be filed electronically with the IRS when the tax season opens.

Check back for more information.