A tax deduction for charitable giving isn’t guaranteed just because you’re feeling generous. As with everything in tax law, it’s important to follow the rules,

Read MoreCategory: individual

Ask The Taxgirl: Married But Faking Being Single

It’s Ask The Taxgirl! Today’s question focuses on filing status, and what could happen if you file as single when you’re really married.

Read MoreAsk The Taxgirl: Standard Deduction Versus Itemized Deductions

It’s Ask The Taxgirl! Today, we tackle claiming the standard deduction versus itemizing your deductions.

Read MoreIRS Reminds Taxpayers To Renew ITINs

The Internal Revenue Service (IRS) has issued a reminder to taxpayers with an expiring Individual Taxpayer Identification Number (ITIN) to submit their renewal applications. Failing to renew

Read MoreUses For Leftover Halloween Candy And The Resulting TCJA Tax Consequences

Have a stash of candy after trick-or-treat? Here are 13 uses for leftover Halloween candy – complete with the tax consequences.

Read MoreA Quick Comparison Of Tax Reform Changes

Tax reform means some pretty significant changes for taxpayers in 2018. Want to know what’s new? Here’s what you need to know – with charts!

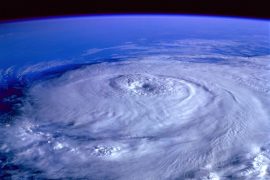

Read MoreIRS Announces Relief For Taxpayers Affected By Hurricane Michael

The Internal Revenue Service (IRS) has announced tax relief for victims of Hurricane Michael.

Read MoreAnswers To Popular Tax Extension Questions

Here are the answers to some of the most popular questions about tax return extensions.

Read More2018 Reimbursements For 2017 Moving Expenses Can Be Tax-Free

The Internal Revenue Service (IRS) has offered guidance for taxpayers who moved in 2017, but expenses weren’t reimbursed or paid until 2018.

Read MoreAs Storm Clean-Up Begins, IRS Warns Taxpayers On Scams

After Hurricane Florence, the IRS has issued a reminder to taxpayers that criminals & scammers will try to take advantage of the generosity of taxpayers.

Read More