A Coinbase customer has filed a motion in federal court seeking to block the Internal Revenue Service (IRS) from issuing a “John Doe” summons on Coinbase. Coinbase, headquartered in San Francisco, California, facilitates transactions of digital currencies like Bitcoin and Ethereum.

Read MoreCategory: IRS news/announcements

IRS Announces 2017 Filing Season Opens January 23, Reminds Taxpayers About Delayed Refunds

The Internal Revenue Service has announced that tax season will open on Monday, January 23, 2017. The IRS will begin accepting electronic tax returns that day, with more than 153 million individual tax returns expected to be filed in 2017.

Read MoreIRS Launches New Online Tool To Assist Taxpayers With Account Balances, Paying Taxes & More

The Internal Revenue Service (IRS) has announced the launch of a new online application to help taxpayers. The new tool, available on IRS.gov, allows taxpayers to view their tax account balance.

Read MoreIRS, State Tax Agencies & Industry Partners Talk Expanded Security Measures For The 2017 Tax Season

The IRS convened with state tax agencies and industry partners this month to talk about plans for improving identity theft protections for taxpayers. The collective message? Cooperation is the key to protecting taxpayers from identity theft related tax fraud.

Read MoreIRS Warns On New Scam Targeting Tax Professionals

The Internal Revenue Service (IRS) is again warning tax professionals about a potential scam involving email and IRS e-services.

Read MoreIRS Issues Reminder That Forms W-2 Are Due Earlier, Some Tax Refunds Delayed, In 2017

If you’re a business owner, be sure to draw a red circle around the date January 31, 2017, on your calendar: that’s the new due date for filing forms W-2. Under the new law, the Protecting Americans from Tax Hikes (PATH) Act, enacted last December, the new filing deadline for employers to submit forms W-2 to the Social Security Administration, is January 31. Here’s more.

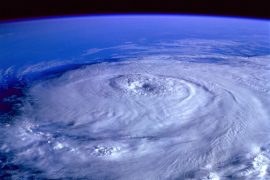

Read MoreIRS Announces Relaxed Retirement Plan Rules For Victims Of Hurricane Matthew

The Internal Revenue Service (IRS) has announced that 401(k)s and similar employer-sponsored retirement plans, including 403(b) and 457(b) plans, can make loans and hardship distributions to victims of Hurricane Matthew and members of their families.

Read MoreIRS Announces Additional Tax Relief For Victims Of Hurricane Matthew

The Internal Revenue Service (IRS) has announced additional tax relief for victims of Hurricane Matthew. Storm victims in much of North Carolina and parts of South Carolina, Georgia, and Florida have until March 15, 2017, to file certain individual and business tax returns and make certain tax payments.

Read MoreIRS Announces Plans To Close Tax Return Processing Sites

The Internal Revenue Service (IRS) has announced plans to close more processing sites around the country. The closures are a part of consolidation efforts and budget-related cost cutting measures. Here’s a look at what sites are closing and when.

Read MoreIRS Warns On New Scam Involving Fake Tax Bills & Affordable Care Act

New scams are popping up every day. Today, the Internal Revenue Service (IRS) and its Security Summit partners issued an alert to taxpayers and tax professionals to be on guard against fake emails purporting to contain an IRS tax bill related to the Affordable Care Act.

Read More