It’s my annual “Taxes from A to Z” series! If you’re wondering whether you can claim wardrobe expenses or whether to deduct a capital loss, you won’t want to miss it.

M is for Marginal Tax Rate.

The marginal tax rate is what most taxpayers actually refer to as their tax rate but it’s not – not exactly. The marginal tax rate is actually your top tax rate. It is the tax rate you’ll pay on the next dollar of taxable income. That’s because the U.S. has a progressive income tax system. A progressive income tax is exactly what it sounds like: the rate of tax increases as income increases. With our system, rates go up as income goes up but – and it’s a big but – everyone pays the same rate for the same income.

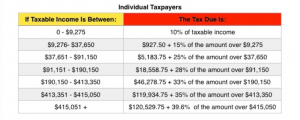

Let’s assume you have taxable income of $100,001 as a single taxpayer. You might look at the Internal Revenue Service (IRS) tax tables (below) and assume your tax rate is 28%. But that’s your marginal tax rate or more simply, your top rate. For federal income tax purposes, every dollar that you make over $100,000 will be taxed at 28% until you hit the threshold for the next rate. But every dollar that you made from the first dollar was not taxed at 28%.

That’s because every dollar of taxable income (income figured after deductions, exemptions, exclusions and other adjustments) from zero dollars to $9,275 is taxed at 10% for every person filing as single. Every dollar of taxable income from $9,276 to $37,650 is taxed at 15% for every person filing as single. Every dollar of taxable income from $37,651 to $91,150 is taxed at 25% for every person filing as single. Every dollar of taxable income from $91,151 to that $100,000 is taxed at 28% for every person filing as single. And so on.

In other words, all taxpayers in the same filing status are taxed at the same rate for the same income.If you want to talk about how much tax you pay overall, then using your marginal tax rate isn’t the best term. A more accurate rate for that purpose is your effective tax rate. The effective tax rate is often described as the average tax rate paid – but the word “average” can be tricky. The average of what? Total tax paid divided by taxable income? Or total federal income tax owed vs. total income? A more sophisticated formula involves taking taxable income divided by the sum of income tax figured before credits (line 55); self-employment tax (SE tax at line 56) and FICA taxes paid (from your W-2) but then you’re starting to do some serious math. No matter which formula you use, your effective tax rate will always be lower than your marginal tax rate.

For more Taxes A to Z, check out:

- A is for Affordable Care Act Reporting

- B is for Back Pay

- C is for Canceled Debt

- D is for Dependents

- E is for Eligible Rollover Distributions

- F is for Fat Finger Error

- G is for GI Bill

- H is for Harvesting Losses

- I is for Investment Income Expense

- J is for Junk Bonds

- K is for Strike Price

- L is for Late Filing & Late Payment Penalties