It’s my annual “Taxes from A to Z” series! If you’re wondering whether you can claim home office expenses or whether to deduct a capital loss, you won’t want to miss a single letter.

L is for Line of Credit

For 2017 (the tax year for which you’re currently filing your tax return), you can deduct qualifying home mortgage interest for purchases up to $1,000,000 ($500,000 if married filing separately) plus an additional $100,000 for equity debt ($50,000 if married filing separately).

Typically, home mortgage interest is interest you pay on a loan secured by your qualified home (your primary residence, second home, or both). The loan may be a mortgage to buy your home, a second mortgage, a line of credit, or a home equity loan.

A home can be a house, condominium, co-op, mobile or manufactured home, boat – even a yurt. A tent won’t do, however: To qualify as a home, the residence must provide basic living accommodations including a sleeping space, toilet, and cooking facilities.

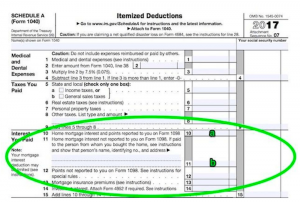

To deduct home mortgage interest, including a line of credit, you must itemize your deductions on a Schedule A. The interest paid is generally reported to you by the lender on a form 1098 – if that’s the case, you’ll report it on line 10 (indicated below with a green “a”). If the interest paid is not reported to you on a form 1098, you’ll report it on line 11 (indicated below with a green “b”).

However, for 2018 (the tax year for which you’ll file your tax return in 2019) through 2025, there’s a big change. For mortgages taken out before December 15, 2017, the cap remains $1,000,000 ($500,000 if married filing separately). However, for new mortgages taken after that time (and through December 31, 2025), the cap is $750,000 ($375,000) for purposes of the home mortgage interest deduction. Additionally, the new law eliminates the deduction for interest paid on home equity loans and lines of credit (again, through December 31, 2025) “unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan.” That means that a line of credit used to improve your home may still be deductible, subject to the $750,000 cap, while a line of credit used for any purpose not related to your home – like to pay off your credit cards – would not be.

For your taxes from A to Z, here’s the rest of the series:

- A is for Annual Contribution Limits

- B is for Bonus

- C is for Choate

- D is for Direct Deposit

- E is for Enrolled Agent

- F is for Found Money

- G is for Ghost Preparer

- H is for Hobby Loss Rules

- I is for Installment Agreement

- J is for Joint Accounts

- K is for Kin (Crypto)