Updated

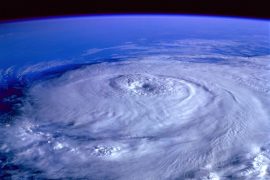

The Internal Revenue Service (IRS) has announced tax relief for victims of Hurricane Michael. Those taxpayers in parts of Florida and elsewhere who have been affected by the storm have until February 28, 2019, to file individual and business tax returns and make certain tax payments.

Relief is available for taxpayers in any area designated by the Federal Emergency Management Agency (FEMA) as qualifying for individual assistance. Currently, affected taxpayers are those in Bay, Calhoun, Franklin, Gadsden, Gulf, Hamilton, Holmes, Jackson, Jefferson, Leon, Liberty, Madison, Suwannee, Taylor, Wakulla and Washington in Florida.

The extension applies to deadlines – either an original or extended due date – that occurred on or after October 7, 2018, and before February 28, 2019.

Deadlines were also extended for certain taxpayers affected by Hurricane Michael in the Georgia counties of Baker, Bleckley, Burke, Calhoun, Colquitt, Crisp, Decatur, Dodge, Dooly, Dougherty, Early, Emanuel, Grady, Houston, Jefferson, Jenkins, Johnson, Laurens, Lee, Macon, Miller, Mitchell, Pulaski, Seminole, Sumter, Terrell, Thomas, Treutlen, Turner, Wilcox, and Worth.

The extension applies to deadlines – either an original or extended due date – that occurred on or after October 9, 2018, and before February 28, 2019.

This includes individual taxpayers who live in the area, as well as businesses, including tax-exempt organizations, with a principal place of business in the area. Taxpayers who live and work in locations added later to the disaster area, including those in other states, will automatically receive the same filing and payment relief. The current list of eligible localities is always available on the disaster relief page on the IRS website. I’ll also update the list of affected counties here as information is made available.

Here’s what the relief entails: Most tax filing and payment deadlines which began starting on October 7, 2018 (or October 9 for those counties in Georgia), will be pushed off until February 28, 2019. That includes returns and payments that were originally due during this period, including individual tax returns on extensions which are due on Monday, October 15, 2018. Remember, however, that extensions are an extension of the time to file, not the time to pay, so payments for 2017 tax returns are still keyed to the April 17, 2018, due date.

Relief also includes a waiver of late penalties for quarterly estimated income tax payments normally due on January 15, 2019, as well as quarterly federal payroll and excise tax returns normally due on October 31, 2018, and January 31, 2019.

Additionally, penalties on payroll and excise tax deposits due on or after October 7, 2018, and before October 22, 2018, will be abated as long as the deposits are made by October 22, 2018.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. That means that taxpayers do not need to contact the IRS to get this relief. However, if you receive a late filing or late payment penalty notice from the IRS and were entitled to relief, you should call the number on the notice to have the penalty abated.

“The IRS has moved swiftly to announce this relief for taxpayers affected by Hurricane Michael in advance of the Oct. 15 extension filing deadline,” said IRS Commissioner Chuck Rettig. “We recognize the devastation this historic storm caused for many taxpayers, and IRS employees stand ready to support the disaster recovery effort as they have done many times in the past.”

The IRS will work with any taxpayer who lives outside the disaster area but whose records are located in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 1.866.562.5227. This includes those workers assisting the relief activities who are affiliated with a recognized government or charitable organization.

Individuals and businesses who suffered uninsured or unreimbursed disaster-related losses can choose to claim them on the return for the year the loss occurred – in this instance, the 2018 return normally filed next year – or the return for the prior year (2017). However, remember that the deduction for personal casualty and theft losses has been repealed for the tax years 2018 through 2025 except for those losses attributable to a federal disaster as declared by the President. For more on casualty losses after a disaster, click here.

For more details on available tax relief, you can also check out the disaster relief page on IRS.gov.