The tax filing season opens on January 27, 2020. If you’re looking for ways to keep on top of things, check out IRS2Go, the official mobile app of the Internal Revenue Service (IRS). With IRS2Go, you can check your refund status, make a payment, and find free tax preparation assistance.

Some of the features on IRS2Go include:

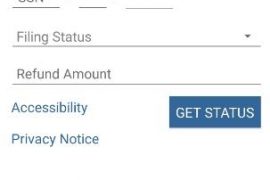

- You can check your tax refund status. You’ll need your Social Security number, filing status, and the amount of your anticipated refund. You can check your tax refund status within 24 hours after the IRS indicates receipt of your e-filed return or about four weeks after you file a paper return. There’s no need to check multiple times in a day: records are only updated by IRS once per day, usually overnight.

- If you’re looking for free in-person tax preparation services, you can use the app to find an IRS Volunteer Income Tax Assistance (VITA) and/or the Tax Counseling for the Elderly (TCE) site near you. Enter your zip code and select a mileage range. You’ll be given a range of options with distance, hours, dates, languages and appointment details (if required) for each. To find the location that works for you, just click on “directions” and the maps app on your phone will help you get where you need to go.

- If you need to file your taxes, you can get free tax software on your phone. Access free tax software from your mobile device to prepare and file your taxes – and get your refund.

- If you owe taxes, you can find mobile-friendly payment options like IRS Direct Pay on the app. You can also make a credit or debit card payment through an approved payment processor.

- IRS2Go can also generate login security codes for certain online services: you can get the codes through IRS2Go instead of through text messages. For more information about IRS online services, visit the Secure Access page on the IRS website.

- You can also connect with the IRS on social media with a few clicks in the app. The IRS has social media accounts on Twitter, LinkedIn, Instagram, and YouTube.

IRS2Go is available for free from the Apple store (iPhone and iPad), the Google store, or from Amazon in both English and Spanish.

HELP…….Can you tell me where to go to find out who used me as a dependent on there tax return , I was rejected twice when I completed information to get the stemus check as a non filer, because someone had used me as their dependent.

If you believe that you are the victim of ID theft, you’ll want to file form 14039: https://www.irs.gov/pub/irs-pdf/f14039.pdf

You can typically also request info from the IRS about the return if you’re a victim, but not if you are listed as a dependent (I’m not sure why not).

But I would definitely start with filing the form 14039 together with your tax return.