It’s my annual Taxes from A to Z series! This time, it’s Tax Cuts and Jobs Act (TCJA) style. If you’re wondering whether you can claim home office expenses or whether to deduct a capital loss under the new law, you won’t want to miss a single letter.

M is for Medical Expenses.

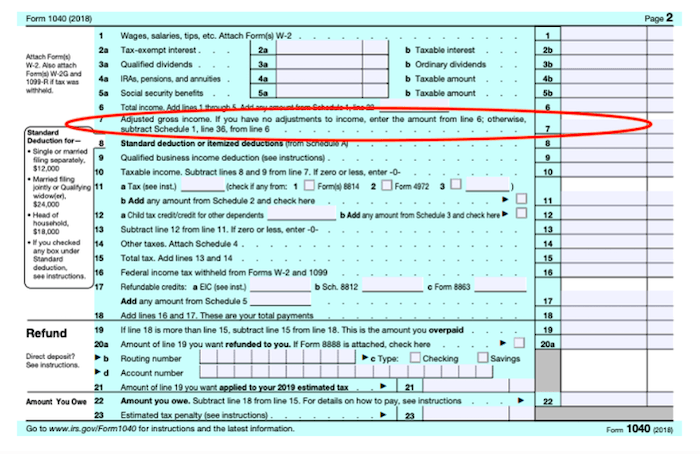

Under the TCJA, the medical expense deduction remains in place, but there’s a catch: the 7.5% floor is back in place for the tax years 2017 and 2018. We call it the “floor” because you can only deduct expenses over 7.5% of your adjusted gross income (AGI). You’ll find AGI on line 7 on page two of the new form 1040:

(You can find out more about the new 1040 and schedules here.)

Here’s an example of how the math works. Let’s say your AGI is $40,000 and your medical expenses were $5,000. That means, for the 2018 tax year, you can claim $2,000 as a deduction, or $5,000 in expenses less the floor (7.5% x $40,000 = $3,000).

In 2019, the floor increases to 10% of AGI. That means that fewer of your medical expenses are deductible. Using the same facts as before, you could claim $1,000 as a deduction, or $5,000 in expenses less the floor (10% x $40,000 = $4,000).

Medical expense deductions are claimed on a Schedule A (downloads as a pdf) on your federal form 1040. Medical expenses are only tax-deductible as a treatment for a diagnosed disease or condition and must be specifically ordered by your doctor (in other words, prescribed). Medical expenses include visits for routine medical, dental and vision care, as well as specialist care, and also include treatments, including medications and follow-up visits. Medical expenses may also include associated out-of-pocket costs, like mileage (for mileage costs in 2018, click here, and for mileage costs in 2019, click here). For more about what you can deduct as medical expenses, check out this prior post.

The timing of your expenses matters, especially with the change in the floor between 2018 and 2019. Here’s what you need to know:

- If you pay medical expenses by check, the expenses are considered paid on the day you mail or drop off the check.

- If you pay medical expenses online through a portal or a secure account, the expenses are considered paid on the date the financial institution (bank, PayPal, etc.) shows that the payment is made.

- If you pay medical expenses by credit card, the expenses are considered paid on the date that the charge shows on your credit card. The date that matters is the date of the charge, not the date that you actually pay off the amount charged.

For more Taxes From A To ZTM 2019, check out the rest of the series:

- A is for Alimony

- B is for Bracket Creep

- C is for Credit For The Elderly Or The Disabled

- D is for Due Dates

- E is for Earned Income Tax Credit (EITC)

- F is for Fair Debt Collection Practices Act (FDCPA)

- G is for Gross Estate

- H is for Home Office Deduction

- I is for Innocent Spouse

- J is for Jackpot

- K is for Kiddie Tax

- L is for Long-Term Capital Gains or Losses