Next week, hopeful taxpayers will begin checking bank accounts for tax refunds. Tax season opened Jan. 24, 2022, and the IRS says most taxpayers who

Read MoreCategory: refund

How To Save (And Spend) A Lump Sum Of Money, Including Your Stimulus Check

Chances are, you’re about to come into some money soon — whether it’s your tax refund or the 2021 stimulus check. But what do you

Read MoreAsk The Taxgirl: My Direct Deposit Is Wrong, So My Tax Refund Is Missing

Taxpayer asks: How can I update my direct deposit information with the IRS? I filed my 2019 individual return through a tax preparer & my

Read MoreIRS To Begin Sending Out Interest Payments To Millions Of Taxpayers With 2019 Tax Refunds

Looking for your interest? The Internal Revenue Service (IRS) will begin sending interest payments to individual taxpayers who timely filed their 2019 federal income tax returns and

Read MoreIRS Has More Than $1.5 Billion In Unclaimed Tax Refunds

The Internal Revenue Service (IRS) may have your money. The tax agency has announced that more than $1.5 billion in outstanding refunds remain unclaimed from 2016. Yes,

Read MoreIRS Will Pay Interest On Tax Refunds For Timely Filed Returns As Of April 15 (*Yes, Really)

If you were entitled to a 2019 tax refund, you may be in store for some good news: individual federal income tax refunds issued after

Read MoreHere’s How Child Support Offsets Affect Tax Refunds & Stimulus Checks

It has long been the case that if you owe money, your federal income tax refund can be seized to satisfy your debt. Examples of

Read MoreWhat Happens To Your Stimulus Check If You Got Your Tax Refund Using A Loan Or Advance?

As COVID-19 continues to impact the United States, the federal government is taking action to ease the burden on taxpayers. Most recently, as part of the

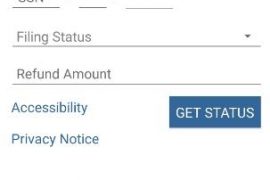

Read MoreCheck Your Tax Refund And More With IRS2Go

The tax filing season opens on January 27, 2020. If you’re looking for ways to keep on top of things, check out IRS2Go, the official

Read MoreFour Alternatives To Consider Before Applying For A Tax RAL

It’s a good idea to mull over other strategies before applying for a tax Refund Anticipation Loan (RAL). Just make sure they’re appropriate alternatives. Here

Read More