It’s my annual Taxes from A to Z series! If you’re wondering how to figure basis for cryptocurrency or whether you can claim home office expenses during COVID, you won’t want to miss a single letter.

V is for Voluntary Withholding.

You already know that if you expect to owe tax at tax time, you should make estimated tax payments. But there’s an additional way that you can pay the government so that you don’t have to write a big check at the end: you can choose to have voluntary withholding from your benefits during the year. This is similar to withholding on your paycheck and means that you should owe less at tax time (or preserve your refund if you’re entitled to one).

Why might you owe? You might be receiving unemployment compensation (yes, it’s taxable), Social security benefit along with other income, Social security equivalent Tier 1 railroad retirement benefits, Commodity Credit Corporation loans, certain crop disaster payments under the Agricultural Act of 1949 or under Title II of the Disaster Assistance Act of 1988, or dividends and other distributions from Alaska Native Corporations to its shareholders. If you’re not certain whether your payment is eligible for voluntary withholding, just ask.

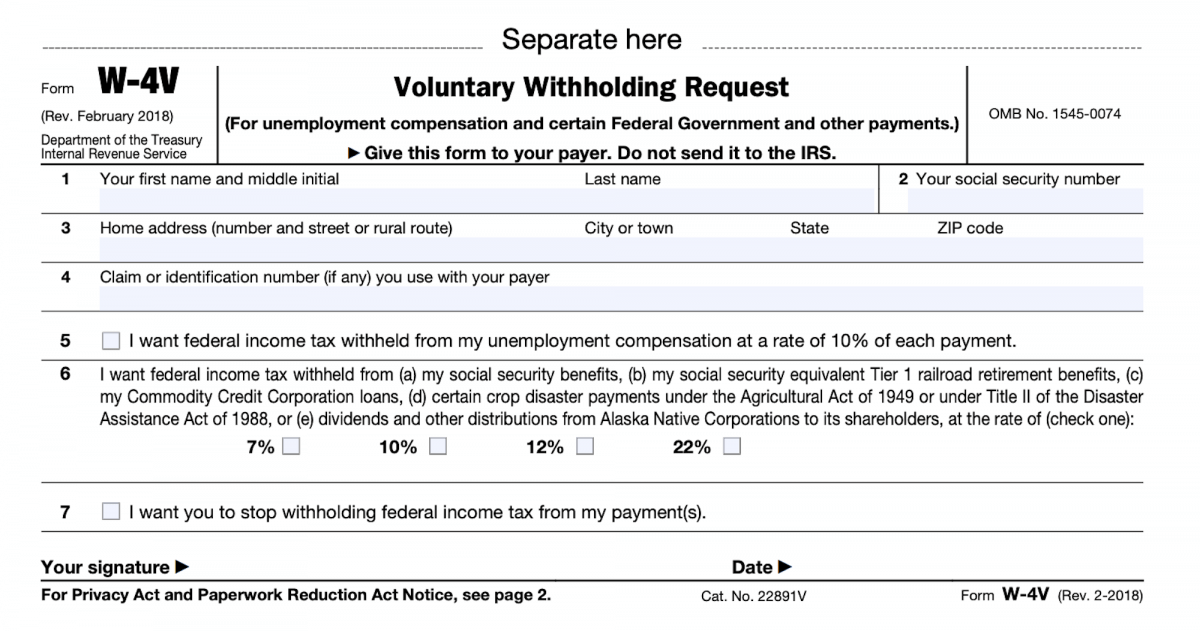

To request voluntary withholding, use Form W-4V (downloads as a PDF) to ask the payer to withhold federal income tax. It’s a very simple form. It looks like this:

Just complete the personal information and tick the box that indicates the percentage you want to have withheld. There are limits on how much you can withhold. For unemployment compensation, the payer is permitted to withhold 10% from each payment. For any other government payment listed above, you may choose to have the payer withhold federal income tax of 7%, 10%, 12%, or 22% from each payment. There are no other options.

You should ask your payer when income tax withholding will begin. It will continue until you change or stop it, or if your payments stop.

You can find the rest of the series here:

- A is for ATIN

- B is for BEAT Regs

- C is for Cryptocurrency Reporting

- D is for De Minimis

- E is for Extended Due Dates

- F is for FTE

- G is for GILTI

- H is for Head of Household

- I is for Inflation

- J is for Jeopardy Assessment

- K is for Kiddie Tax

- L is for Legal Entity

- M is for Mark-to-Market Taxation

- N is for Nexus

- O is for Ordinary and Necessary

- P is for Personal Exemption

- Q is for Qualified Appraisal

- R is for Required Minimum Distributions

- S is for Sunset

- T is for Tax Home

- U is for Undue Hardship